Evernorth Rural Ventures

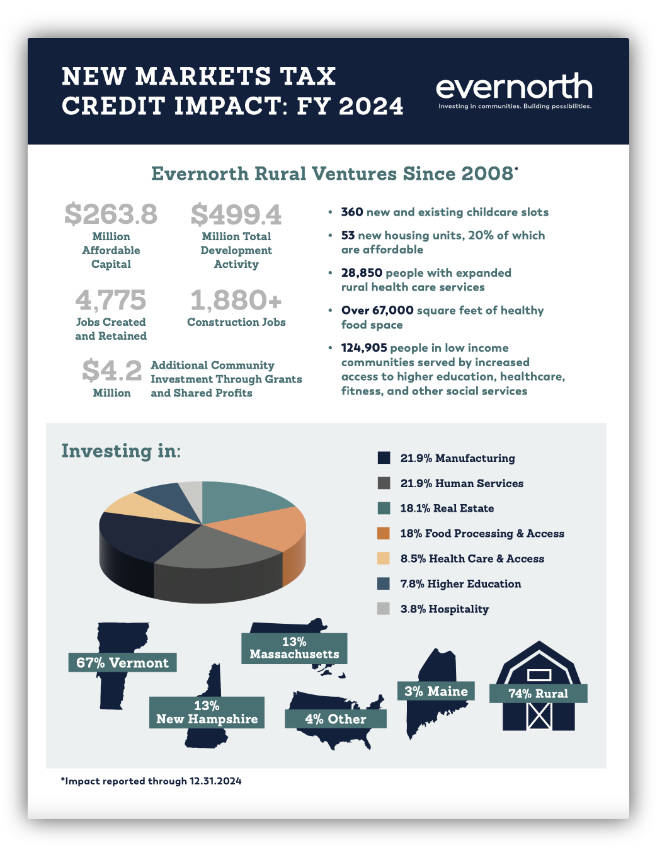

Evernorth Rural Ventures (ERV), a qualified CDE, uses its NMTC resources to support investment in the economic, environmental, and social well-being of northern New England communities and its regional economies. NMTC funds are used to retain and create quality jobs and essential goods and services by financing key community developments in downtown and village centers and in other concerted community efforts that demonstrate positive impacts to low income persons and communities.

A variety of projects are eligible including, but not limited to retail and office space, health care, downtown housing over commercial space, manufacturing, community centers, forest and food processing, grocery stores and education. Prospective NMTC projects need to be located within a qualified census tract. Evernorth Rural Ventures targets the majority of its NMTC resources to rural areas within its service area.

We encourage you to call Beth Boutin at (802) 863-8424, or use the contact form to send a message to learn more about Evernorth Rural Ventures and New Markets Tax Credits.

Is the NMTC right for me?

To see if the program may work for financing your business, please review the questions below.

To receive NMTC-funding, a business must be located in a federally-defined low income census tract. Please contact Beth Boutin at BBoutin@evernorthus.org.

Projects must be located in an eligible qualified NMTC census tract. ERV targets a majority of its NMTC investments to rural communities and finances projects that create or retain quality jobs and essential services that materially improve the lives of low income northern New Englanders.

NMTC equity can provide 20-25% of equity, like gap financing to a project or business.

Most NMTC-funded businesses and projects receive financing that involves more favorable terms and conditions than those the market typically offers and may include some of the following:

- Below market interest rates

- A longer than standard period of interest only loan payments

- Higher than standard loan to value ratio

- A longer than standard amortization period

- More flexible borrower credit standards

- Nontraditional forms of collateral

- Lower than standard debt service coverage ratio

- Subordination

A typical NMTC funding request is between $3 and $35 million, though the total project size may be larger. An NMTC financing request of more than $10 million requires the participation of multiple NMTC awardees.

NMTCs are very flexible and can be used for almost any kind of business, including manufacturing, downtown real estate development, community centers, health care, essential services, office space, downtown housing over commercial space, and farm, food and forest processing.

The following are exceptions:

- Private or commercial golf courses

- Country clubs

- Massage parlors

- Hot Tub facilities

- Suntan facilities

- Racetracks or other facilities used for gambling

- A store whose principle business is the sale of alcoholic beverages for consumption off-premises

- Farms

- Any trade or business consisting predominantly of the development or holding of intangibles for sale or license

Additionally, less than 80% of gross income must come from rental of dwelling units, and a portion of any residential rental units may be required to be reserved for low-income residents.

The majority of NMTC financing is delivered as debt with favorable financing terms, though equity or equity-equivalent financing may be available in special circumstances.

In accordance with federal law and the U.S. Department of the Treasury policy, this institution is prohibited from discriminating on the basis of race, color, national origin, sex, age or disability. To file a complaint of discrimination, write to Department of the Treasury, Office of Civil Rights and Diversity, 1500 Pennsylvania Ave. NW, Washington D.C., 20220 or call (202) 622-1160.