A closer look at Vermont’s widening gap between wages and housing

Wage Growth Doesn’t Equal Affordability

At first glance, Vermont’s economy looks healthy. Wages are rising, unemployment is low, and many local businesses report strong demand. For a moment, it seems like good news all around.

But look closer, and you’ll see a different picture. While some Vermonters are doing better, many others are falling further behind. It’s a bit like celebrating a town’s “average” income because a new tech company moved in, even though most longtime residents are earning the same as last year. We are all happy for the new opportunities, but those opportunities are not equally shared.

That’s what’s happening in Vermont. And it hasn’t kept pace with either average wages or the cost of living.

Averages Hide the Inequality

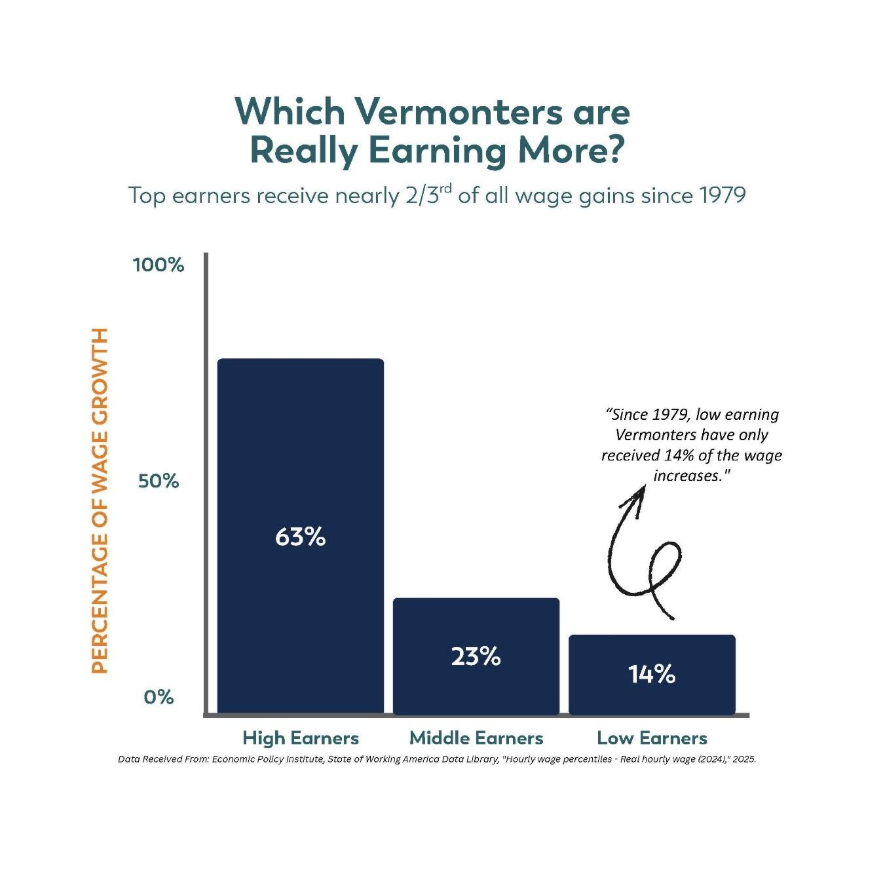

In Vermont, as across the country, wage growth has been uneven for decades. Higher earners have seen their pay grow much faster than those in the middle or at the bottom of the income scale. Between 1979 and 2019, wages for middle-income workers grew by less than half a percent annually, while top earners saw double that rate1. Even during the recent period of strong labor demand, when wage compression briefly narrowed the gap, the typical Vermont household still lagged far behind rising housing costs.

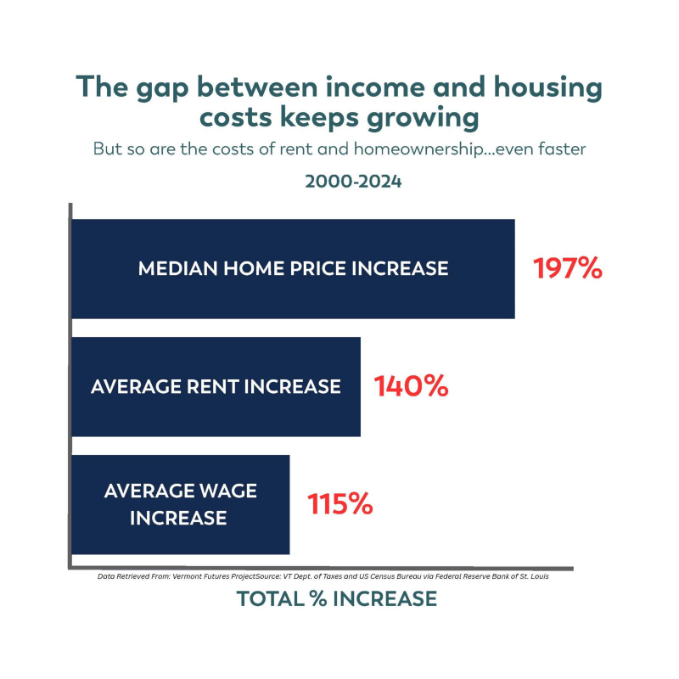

The Vermont Futures Project illustrates this trend clearly. The line showing home sale prices has risen steeply year after year, while the line showing household income climbs at a much gentler slope. The distance between those two lines, the affordability gap, keeps widening.

The result is that Vermont’s economy is stronger on paper than it feels on the ground. Many workers earning $20 to $25 an hour, such as retail staff, caregivers, construction workers, and municipal employees, are finding that the numbers no longer add up.

A full-time worker earning $25 an hour brings home about $52,000 a year before taxes. To stay within a reasonable budget, that person can afford roughly $1300 in rent2. Yet in many Vermont towns, the average two-bedroom apartment now rents for $1700 or more3. In some areas, even modest homes sell for over $400,000, far beyond the reach of most working families4.

Why Wages Can’t Keep Up

The affordability gap is not caused by one thing. It is a combination of high costs and unequal gains. Construction costs have soared, driven by the price of materials, limited labor supply, and new federal “Build America, Buy America” (BABA) rules that, while well-intentioned, have made some projects more expensive. Inflation, financing rates, and supply chain pressures all add up.

Even when paychecks grow a little, the cost of everything else, from groceries to gas to childcare, grows faster. The math simply doesn’t work for most Vermont families.

The Human Side of the Numbers

We see the effects of this every day. In Franklin County, average rents have climbed nearly 30 percent in the past five years, far faster than local wage growth, a pattern repeating across Vermont. According to the Vermont Housing Finance Agency’s (VHFA) Between a Rock and a Hard Place report, the median rent for a modest two-bedroom apartment in Franklin County reached $1,356 in 2023, while the median renter income would support a rent of only about $1,0005.

These people are not outliers. They are our neighbors, our coworkers, our customers, and the backbone of our communities. They are the Vermonters who care for our elders, teach our children, fix our roads, and keep our local businesses running. But too often, they can’t find or afford a place to live near where they work.

When we look only at wage growth data, we miss this reality. The numbers make it seem as though working Vermonters are better off. But when the cost of housing, healthcare, and necessities rise faster than pay, many families are falling behind even as the economy grows.

A Structural Problem Demands Structural Solutions

Housing affordability is not just about what a home costs. It is about what people earn, and what opportunities those earnings afford. When wages stagnate but construction costs and rents climb, the result is a structural mismatch that market forces alone cannot solve.

That is why public investment in affordable housing is not a luxury or a subsidy for inefficiency. It is an essential part of a functioning economy.

Affordable housing is infrastructure. Just like roads, schools, and broadband, it is what keeps communities working. It ensures that the people who power our economy, teachers, caregivers, retail workers, and tradespeople, can afford to live and thrive in the same places they serve.

Building a Path Forward

At Evernorth, we see this as both a challenge and an opportunity. Every day, we partner with communities, investors, and public agencies across Vermont, New Hampshire, and Maine to create and preserve affordable housing.

Together, we leverage federal programs, local partnerships, and private capital to build homes that working people can afford. This public-private model keeps Vermont’s direct costs low while multiplying every state dollar through private investment. It also helps channel federal housing funds back into Vermont, ensuring that national programs produce tangible local results and lasting community benefits.

We cannot fix income inequality on our own. But we can ensure that our housing system responds to the realities of today’s economy, not just the averages.

When we invest in affordable housing, we invest in Vermont itself. We invest in the nurses, carpenters, and childcare providers who hold our towns together; in the seniors who want to age in their communities; in the young families who want to put down roots here.

Averages may make the headlines, but real progress happens when every Vermonter has a place to call home.

[1] Economic Policy Institute, “State of Working America Data Library: Wages by Percentile, Vermont. (1979–2019)”; Vermont Futures Project, “Home Sale Prices vs. Median Household Income, 2024.”

[2] U.S. Department of Housing and Urban Development (HUD), “Affordable Housing Overview,” 2023.

[3] National Low Income Housing Coalition, Out of Reach 2024: Vermont

[4] Vermont Department of Taxes, Property Transfer Tax Annual Report 2023 and Vermont Housing Finance Agency, Housing Market Snapshot, 2024

[5] Vermont Housing Finance Agency, “Between a Rock and a Hard Place: Vermont Housing Data 2023.”